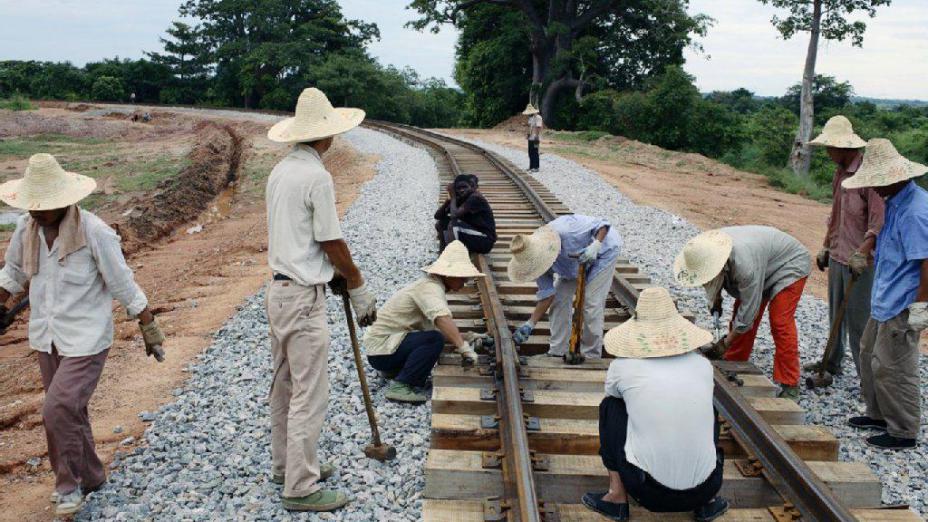

First, increased investment in Africa’s infrastructure is critically needed. The substantial an rapidly increasing amount of capital being allocated to this sector provides a great growth opportunity.

Second, there are compelling opportunities across the continent for consumer goods and services, particularly given limited growth opportunities in much of the developed world. This opportunity for investment in consumer growth across Africa is underprimed by three trends: a growing population, rapid urbanisation and an emerging middle class.

However, it’s important not to discount commodities, which will remain the most obvious opportunity. Africa holds a large proportion of the world’s mineral reserves, and the continent’s significant reserves of oil and gas make it well poised to play a key role in the supply of the world’s energy needs, particularly as other emerging economies grow and the demand for precious metals follow suit.

Free movement of people and goods will also be a major driver of growth in Africa in the coming years.

Source: African Businees, May 2017

afric-Invest

afric-Invest