Nigeria is the largest economy in Africa, with a Gross Domestic Product greater than USD 500 billion. We grew steadily at over 7 per cent per annum between 2005 and 2014, but this growth has been slower in 2015. This growth was driven primarily by the non-oil sectors, such as financial services, telecommunications, entertainment, etc. Foreign direct investment (FDI) inflows have been strong, averaging USD2 billion per quarter since 2013, with over 70 per cent of this in the non-oil sectors. Nigeria’s economy is actually more diversified than it seems, with the oil sector contributing only about 14 per cent to GDP. Nevertheless, we ought to be doing more to diversify with the significant natural and human resources with which Nigeria is blessed. There is no doubt that oil has contributed substantially to Nigeria’s revenue since its discovery in 1956 and more especially, since 1970 when its price was on the upward trend. Yet, oil receipts and their management have challenged governance to the core over time in Nigeria. Deeper economic diversification is an urgent necessity to undertake structural transformation, buffer the domestic economy from externally transmitted shocks and accelerate growth accompanied by job creation. The task ahead of further diversification of the economy is enormous. We do not take it for granted. It will not happen quickly or easily and Nigeria shall be strategic about diversification. We are however encouraged by the strides that have been made in some sectors already. I will use three sectors or categories as examples:

Continue reading Nigeria is the largest economy in Africa

All posts by Michael Patotschka

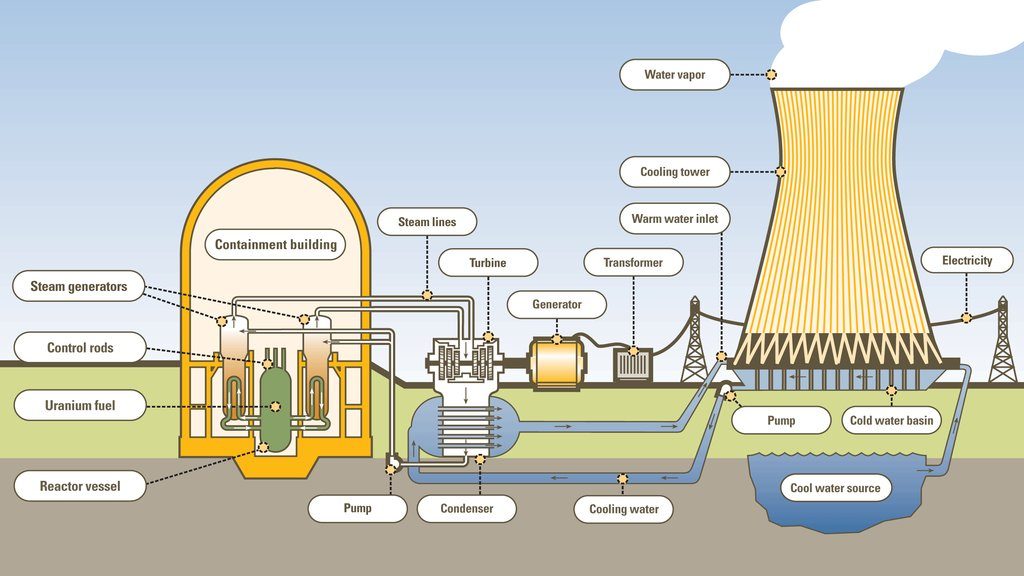

Nigeria will build four nuclear power plants

Nigeria is in talks with Russia’s Rosatom to build as many as four nuclear power plants costing about $ 80bn as Africa’s biggest economy seeks to add 1 200 megawatts of capacity by the end of the decade.

Peak electricity output of Africa’s biggest economy is about 3 800 MW, with a further 1 500 MW unavailable due to gas shortages. South Africa, with a third of Nigeria’s population yet eight times more installed capacity has also signed an agreement with Rosatom as the nation looks to add 9 600 MW of atomic power to its strained grid.

Rosatom would hold a majority, controlling stake in Nigeria’s nuclear facility, while the rest would be owned by the country, with roles to be specified in contracts.

The plants would be financed by Rosatom, which would than build, own, operate and transfer them to the government.

Nigeria, with a population of around 170 million, broke up its monopoly on power generation and distribution by privatizing the sector two years ago, hoping to attract foreign investors.

Source, Business Report International, 15th April 2015, Daily News, 15th April 2015

Nigeria will be a bigger economy than Germany in 2050

Appel: Nigeria Will Benefit Tremendously from Free Trade Agreements

Chief Executive Officer of Deutsche Post DHL Group, Mr. Frank Appel

Chief Executive Officer of Deutsche Post DHL Group, Mr. Frank Appel, who was in Nigeria recently, spoke on the opportunities in the country and other African countries as well as the expansion drive of his company. Obinna Chima presents the excerpts:

There are concerns about low intra-trade in Africa. What should be done for it to improve?

The best things countries can do, like they do even in developed countries is to open their borders and create free trade because these are tremendous opportunities for growth. So, the idea to create an African Union like the European Union with free trade all over the place would be a fantastic idea. Particularly, Nigeria will benefit tremendously from that I have no doubt. So there is a huge opportunity for the continent to really create free trade agreement which is of course not easy to do.

I think that will be a step forward for the whole continent in the push for growth. I said it in Asia, I said it in Germany about the American-European trade agreement, and wherever I go I talk always about it. We have made a study with a University in Spain where we analysed how the human development index is and how much countries are connected. The most connected countries of the world have the highest human development index and most of them are in Europe. The Netherlands is number one.

Singapore is an example from Asia, very open, free trade is possible. Singapore came from more or less an area like Lagos. They did that by opening their borders to other countries and investing heavily in infrastructure and education. I think if Nigeria follows that model and get free trade agreements with many neighbours it will be a tremendous push for the economy.

Looking at the fact that e-commerce is growing rapidly in Nigeria and logistics is equally a challenge when it comes to moving goods, what does DHL have to offer in this regards?

One of the challenges that logistics companies are facing is transparency and cross border processes which are quite challenging in some countries than infrastructure and education. Some countries don’t have enough talent to support the potential growth they have, that is common in most African countries I believe. The border processes are very complex. You need a lot of paper work and official approval for many things which are very different for many developed countries where the processes are automated and very simple, and that cost money. These are the three things we always say needs to be improved – border processes, infrastructure and education.

E-commerce actually is very interesting because Nigeria definitely will jump from small shops into the e-commerce world because you have probably not the space, nor the time or money to build retail malls. So, the whole market will move from where you are now to the e-commerce world straightaway and that will create significant opportunity for companies like us because we know how to operate in the delivery area. That creates a significant opportunity, and we try to expand our activities in many African countries. But we need customers too, we are not a manufacturing company who builds big plant somewhere and then produces there. Our companies are investing and then they create revenue streams for us as well and then we expand our operations.

How do you see the emerging markets and why is DHL interested in them?

First of all, we have always been interested in emerging markets, we have in Africa a long tradition and also in Asian we long to do so and we relate with long term growth. So, the whole of Africa has a Gross Domestic Product (GDP) which is smaller than Germany, but with ten times the population. That tells me there is huge opportunity. And, if Africa gets things in the right direction as we have seen in the last few years, with stability of legislation and government, I think these markets will grow significantly and that creates a massive opportunity for companies like us. And there is nobody else offering such emerging markets like Africa, so for us it is a great opportunity.

Apart from Nigeria and South Africa, what other emerging economies are you looking at in Sub-Saharan Africa?

We are pressing with our express business in all countries; also we have operations in South Sudan so we are active in all countries. In the other bigger countries we have Nigeria and South Africa, Eastern Africa and some western African countries, these are some of the countries we are looking at.

How do you see the proposed merger between TNT and Fedex, do you consider this a threat?

First of all, on a global scale, we have always had that the merger between TNT and Fedex and that should be the decision of the antitrust authority. If it is not approved, we will continue to gain market share, if it approved we will continue to gain market share as well. The footprint of TNT and the combined footprint of all Fedex operations in Africa is smaller than our footprint in the continent.

So, integration is always challenging and we can leave it both ways. It will not be our decision that will be decided by antitrust authorities. If approved, then fine, if not, it is fine for us too. We don’t see that as a threat.

We have grown in Africa significantly over the last years, also in Nigeria; we have gained market share all over the place so we will continue to invest. We will invest in the next one and half years across our key divisions, $20 million here in Nigeria to expand our capabilities. These investments are to improve service quality, to avoid traffic jams, we are investing in distribution centre and further upgrades and that will happen over the next one and half years because we the opportunity in the market.

How autonomous will the Nigerian business be talking about your global restructuring?

The emerging economies will be an important part of the restructuring because we expect that we will grow a lot of revenue by 2020. We want to increase our revenue in the emerging markets from 22 per cent to 30 per cent.

How much is Nigeria contributing to your turnover?

It is very tiny, about 0.2 per cent. I think that is a wrong comparism because we do almost $1 billion revenue in the whole of Africa. Our total turnover globally is more than 10 per cent of Nigeria’s GDP, we are a huge company. It is a little bit incomparable, it will change significantly. I have no doubt that business in Nigeria will be significantly larger if the economy continues to grow. There are predictions that Nigeria will be a bigger economy than Germany in 2050. If that happens, our business will probably be much bigger than it is now.

What challenges are you encountering in expanding your portfolio in recent times?

The limitations are somehow driven by what is being underlined by economic growth and what is the predictability for our customers. Customers are nervous to invest if they don’t see long term predictability in regards to the government’s stability and legislation. These are the biggest requirements. Next is infrastructure. If we have volatile energy supply, congested infrastructure, that is challenging. And the third is education. If you don’t find properly educated people, it limits your growth. If you look into that, it has been the success of China. China has very good educated people; they have excellent infrastructure, very predictable regulations and that has helped them tremendously to attract a lot of investment from foreign countries but why should everything go to China.

Why should companies move to China, what they need is reliability and stability in government, business outlook, open borders clear regulations, good infrastructure and good education. The better countries are getting attraction on these aspects, the more Africa will prosper. That is at least what we expect and we are very optimistic that because for trend in the last 10 years has been in the right direction all over the continent.

What innovation products or services are you looking at to drive growth in Nigeria and some of the emerging markets?

We have quite a lot of innovative products but I think it’s probably too early to introduce them as well. We have lockers deployed all over Germany for parcel delivery for 24 hours daily, we can drop parcels and pick and we have done that in over 15 years in Germany. There are other solutions we have for Nigeria but they are capital intensive. There are plenty of ideas but the market is not ready yet to deploy them here so, we are not developing specifically our innovations for African market because we believe that from the cost perspective and capital intensity perspective, it is not ready yet.

Source: Thisday, 2nd September 2015

Nigeria, Others to Attract $73.5bn Foreign Investments in 2015

By Eromosele Abiodun

Following plans by United States retail giant, Walmart to enter Nigeria’s retail market, increasing greenfield investment from China, India and South Africa, foreign investments in Nigeria and other African countries are expected to reach $73.5 billion by the end of this year.

A report by the African Economic Outlook (AEO) revealed that official remittances have increased six-fold since 2000 and are projected to reach $64.6 billion in 2015 with Egypt and Nigeria receiving the bulk of flows.

The AEO is a product of collaborative work by three international partners: the African Development Bank (AFDB), the OECD Development Centre and the United Nations Development Programme (UNDP).

Official remittances, the report added, remained the largest source of international financial flows to Africa, accounting for about 33 per cent of the total since 2010.

Conversely, the report predicted that Overseas Development Assistance (ODA) will decline in 2015 to 54.9 billion, “and is projected to diminish further”.

“More than two-thirds of states in sub-Saharan Africa, the majority of which are low-income countries, will receive less aid in 2017 than in 2014. FDI is diversifying away from mineral resources into consumer goods and services and is increasingly targeting large urban centres in response to the needs of a rising middle class.

“African sovereign borrowing is increasing. Private external flows in the form of investment and remittances are driving growth in external finance. Despite significant improvements in tax revenue collection over the last decade, domestic resource mobilisation remains low. Public domestic finance in Africa has increased more than threefold in a decade from $157 billion in 2003 to $507 billion in 2013. Compared to 2012, total tax revenue in 2013 registered a slight decrease of about 1.5 per cent mainly on account of lower resource rents, “the report revealed.

According to the report, “The report added that recent trends in African total trade flows – exports and imports – highlight a shift in trade dynamics and increasing competition from China for the African market. Although Europe remains Africa’s largest trading partner, Africa’s trade with Asia rose by 22 per cent between 2012 and 2013, while trade with Europe grew by just 15 per cent.

Manufactured exports from Europe to Africa fell from 32 per cent of the total in 2002 to 23 per cent in 2011. On the other hand, Asia’s share in Africa’s trade rose from 13 per cent of the total to 22 per cent during the same period. In 2009, China overtook the United States as Africa’s largest single trading partner.”

Source: Thisday, 12th August, 2015

World Bank raises forecast for 2015 global crude prices

Washington – The World Bank is nudging up its 2015 forecast for crude oil prices from 53 dollars in April to 57 dollars per barrel after oil prices rose 17 per cent in the April to June quarter.

The forecast is contained in the bank’s latest Commodity Markets Outlook released on Wednesday.

The bank said energy prices rose 12 per cent in the quarter, with the surge in oil offset by declines in natural gas and coal prices.

However, it said it expected energy prices to average 39 per cent below 2014 level.

“Natural gas prices are projected to decline across all three main markets including the United States, Europe and Asia.

Continue reading World Bank raises forecast for 2015 global crude prices

afric-Invest

afric-Invest