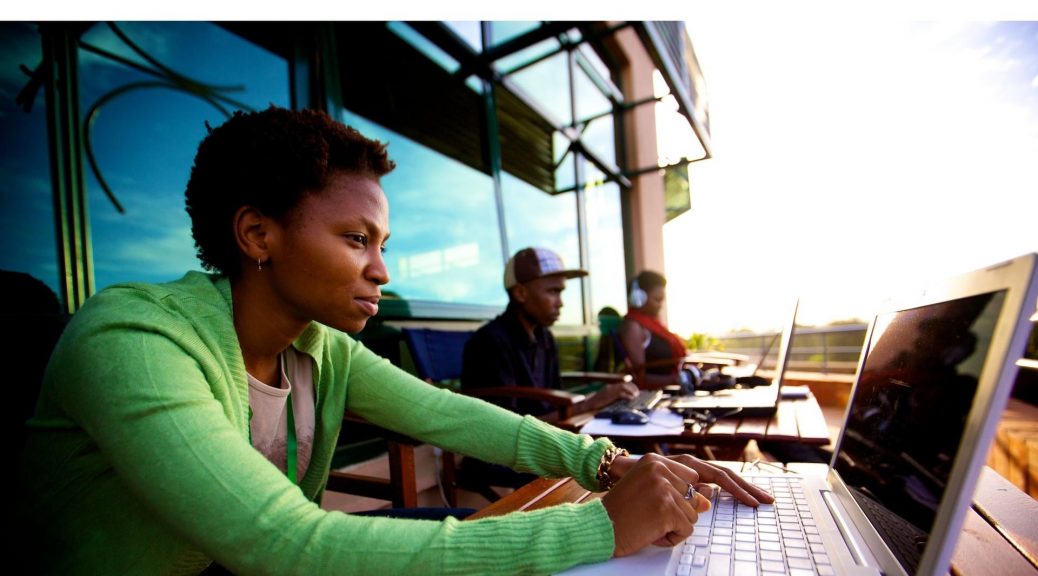

Mobile phone subscriptions are now almost eight times higher in Africa than in 2000, reaching about 700 million. According to a new report by the International Telecommunications Union, mobile technology has played a crucial role in promoting financial inclusion in sub Saharan Africa, where fewer than 20 per cent of households have access to formal financial services. … Mobile phone banking services are especially prevalent in Kenya and penetration rates are also relatively high in Uganda and Tanzania. The other countries with high mobile money account penetration rates are Côte d’Ivoire, Zimbabwe, Botswana, Rwanda and South Africa.

Regulaory reforms and liberalization have also benefited local mobile operators, with countries such as Ghana, Nigeria and Tanzania having more than five local operators.

The report said sub Sahara Afric’s greatest development change is to move from an economic growth path based on commodity exports to a more sustainable industrial and services path. The mobile technology revolution can support and underpin this economic diversifications, experts say.

Source: African Courier, June/July 2016

afric-Invest

afric-Invest