The Foundation says that Africa could do much better in using the financial resources at its disposable to achieve development outcomes.

June 21st, 2024 ByLuke Kilian

Africa must put in place new processes to allocate “dormant or misused” funds in order to meet the Sustainable Development Goals by 2030 and the African Union’s Agenda 2063, argues a new report from the Mo Ibrahim Foundation.

While the annual cost of achieving the SDGs and the African Union’s Agenda 2063 in Africa is estimated by various sources at between $870bn and $1.3 trillion, Africa’s four main sources of finance (revenues, personal remittances, official development assistance and foreign direct investment) amounted to just $829.7bn in 2022, the Foundation reports.

However, the report argues that resources mostly exist, but either lack the relevant processes to be effectively allocated or are either dormant or misused.

Mo Ibrahim, the Sudanese-British telecoms billionaire who chairs the foundation, said that Africa must overhaul its processes to ensure money is getting to where it is needed.

“We need a complete change of paradigm. This is not about Africa coming to the developed world with a begging bowl and developed countries considering how much more they can pledge. This is about smarter money, not just more money. As this report outlines, the money is already there. But current processes prevent resources from being used to properly address the challenges.”

“What I hope this report will show…is that the money is there, but mainly stuck in pipes, or misused.”

That echoes arguments made by the African Union. Domestic resource mobilisation could cover 75-90% of the financing needs for Agenda 2063 on average per country, according to the African Union.

“The money to finance Africa’s future is right here on the continent and within the global African diaspora. It lies in our natural resources, our people, and our innovations,” says Nardos Bekele-Thomas, CEO of African Union Development Agency.

The issue, however, is that the resources are not being used and remain dormant. Issues highlighted by the report include illicit financial flows (IFFs) – which cost Africa an estimated $100bn a year – and weak tax systems.

The money raised from ending IFFs could surpass both ODA received ($81bn annually) and remittances sent back to the continent ($97bn annually).

On taxes, Africa has the lowest government revenue in the world. In 2024, only 5 countries comprise over half (53.7%) of total Africa’s revenues: South Africa, Algeria, Egypt, Morocco and Nigeria.

“With the average tax-to-GDP ratio in Africa still at 15.6%, half the OECD average, strengthening tax systems appears a quick win. Indeed, Africa lost $46 billion in corporate taxes due to tax incentives in 2019, more than half of ODA received,” the Foundation says.

Debt not the answer

Africa’s total external public debt has almost tripled since 2009, rising from $220bn to $655bn in 2022. This is the highest public debt stock Africa has had in over a decade. Countries have had to cut essential public spending, diverting development funds to debt servicing.

“Debt cannot be the way out, as stock and servicing costs have tripled since 2009, and its increasingly complex structure renders traditional relief efforts obsolete,” the report finds.

Arkebe Oqubay, former senior minister and special adviser to the prime minister of Ethiopia and a contributor to the report, says that debt cancellation must be high up the agenda.

“Debt cancellation and restructuring should be the core solution to address the debt stress and financial pressure in African countries. It is of the utmost urgency to establish new financing mechanisms for African development.”

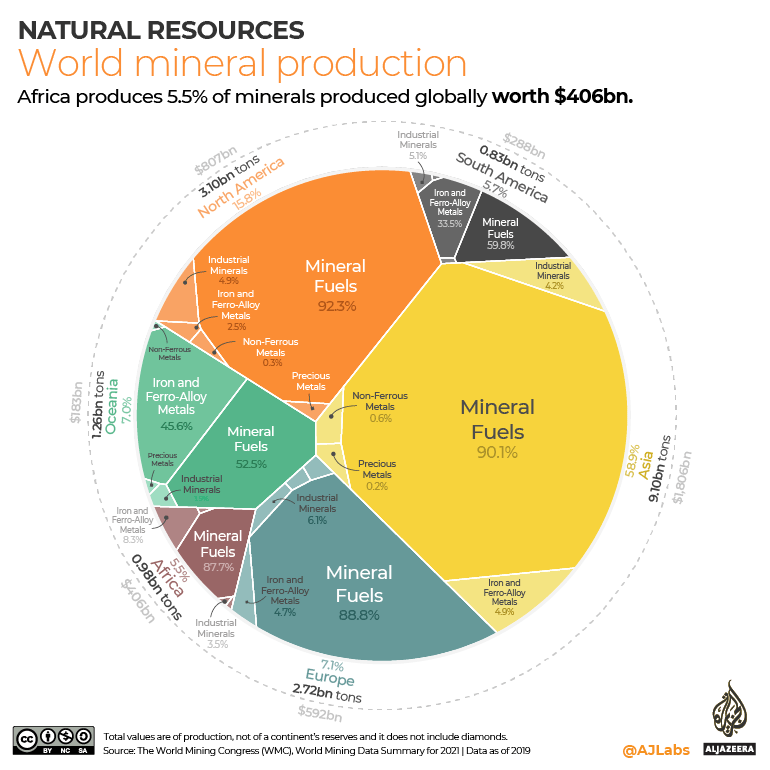

Utilising Africa’s resources

With the ongoing green revolution, Africa’s mineral reserves are in high demand as they are critical for renewable energy and low-carbon technologies. The report suggests that for the continent to make the most of this, it will have to not just produce raw materials but manufacture, design and refine them, in order to access higher value chains. More than 70% of the world’s cobalt is produced in DR Congo, yet Chinese companies account for 68% of the global cobalt refining capacity. Around 80% of the DR Congo’s cobalt output is owned by Chinese companies which produce higher value products such as batteries.

Another way to unlock more money is through Africa’s carbon-sinking capacity, according to the report. The Congo Basin forest offsets more than the whole African continent’s annual emissions. According to the African Carbon Markets Initiative (ACMI), Africa only uses 2% of its annual carbon credits and should aim to sell $100bn worth of credits a year by 2050.

Source, African Business, 21st June 2024

afric-Invest

afric-Invest